us japan tax treaty dividend withholding rate

Thus for example a US. Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or periodic income may be exempt by reason of a treaty or subject to a reduced rate of tax.

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Resident receiving a dividend from a Spanish company would be exempt from Spanish tax.

. A 15 rate applies under domestic law if the home country exempts the dividend from tax or permits a 15 or greater credit for corporate taxes paid by the company paying the dividend. Ratification Was Advised by The Senate of The United States on November 29 1971. 30 rather than 15.

A proportional tax is a tax imposed so that the tax rate is fixed with no change as the taxable base amount increases or decreases. These treaty tables provide a summary of many types of income that may be exempt or subject to a reduced rate of tax. The amount of the tax is in proportion to the amount subject to taxation.

Senate approved four treaty protocols with Japan Luxembourg Switzerland and Spain. For residents of non-EEOI regulated countries a final WHT at a 30 rate applies. In 2019 after several years of delays the US.

The simplest way to obtain this credit is if your foreign tax withholdings are 300 or less per individual 600 if filing a joint return and you have received a 1099-DIV or 1099-INT form from your broker outlining your total foreign tax withholdings. The MIT withholding rate on income attributable to a trading business amounts from certain cross-staple arrangements and rents from agricultural land and certain residential housing is set at a rate equal to the top corporate tax rate ie. Proportional describes a distribution effect on income or expenditure referring to the way the rate remains consistent does not progress from low to high or high.

The reduced rate applies to dividends paid by a subsidiary to a foreign parent corporation that has the required percentage of stock ownership. No US tax is imposed on a dividend paid by a US corporation that received at least 80 of its gross income from an active foreign business for the three-year period before the dividend is declared. Entitlement to the lower rate depends on how the dividend will be taxed in Australia.

Dividends paid to IRAs and Roth IRAs may be subject to a zero rate of withholding tax. It Was Ratified by the President of the United States on. A Convention Between The United States And Japan For The Avoidance of Double Taxation And The Prevention of Fiscal Evasion With Respect to Taxes on Income Was Signed at Tokyo on March 8 1971.

The 10 rate applies to interest paid in respect of the public issues of.

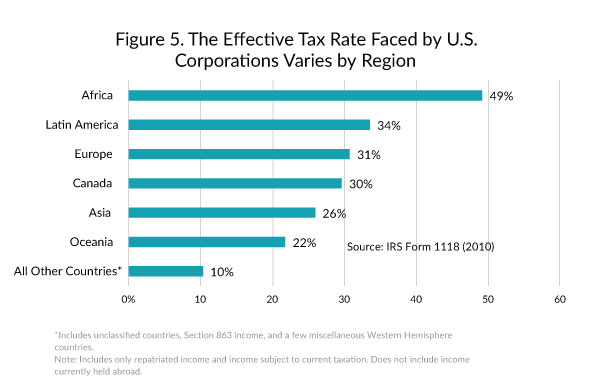

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

Should The United States Terminate Its Tax Treaty With Russia

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

Japan United States International Income Tax Treaty Explained

Non Citizens And Us Tax Residency Expat Tax Professionals

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

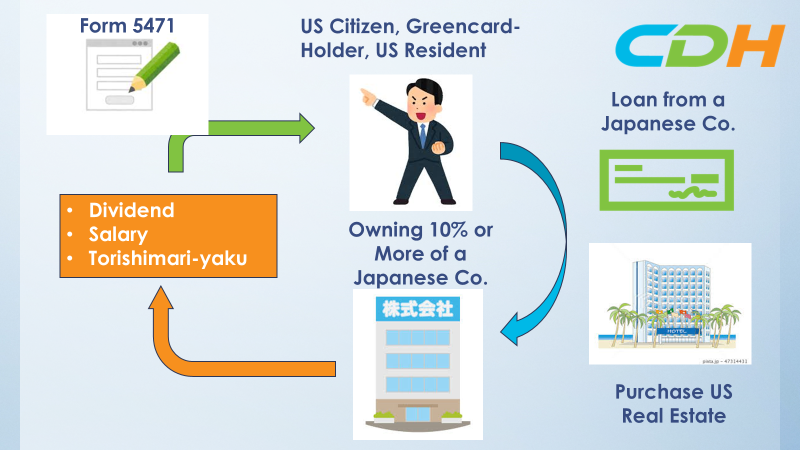

Us Citizens Owning A Japanese Company Us Tax Compliance Risks Cdh

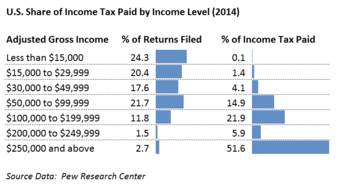

Taxation In The United States Wikiwand

Japan United States International Income Tax Treaty Explained

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Taxation In The United States Wikiwand

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Doing Business In The United States Federal Tax Issues Pwc

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Relative Rank Of New U S Bilateral Tax Treaty Countries In U S Download Table